• Manage and supervise all bookkeeping tasks, including accounts payable and receivable, payroll processing, bank reconciliations, and general ledger entries. Full charge bookkeeper duties include preparing the balance sheet and income statement at the end of the month. They are run after the books are closed and are submitted to a CPA to verify accuracy and then to the owners or management to apprise them of the financial health of the company.

The Top Full Charge Bookkeeper Skills

- By conducting financial analysis, you help drive informed decision-making, identify areas for improvement, and contribute to the overall financial success of the company.

- While regular bookkeepers handle daily tasks under supervision, full-charge bookkeepers often operate independently, taking on additional accounting duties that affect the company’s bottom line.

- Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice.

- By ensuring the accuracy of financial data, full-charge bookkeepers provide business owners and management with a clear view of the organization’s financial position and cash flow.

- We’ll help you get the right information and will support you throughout the hiring process.

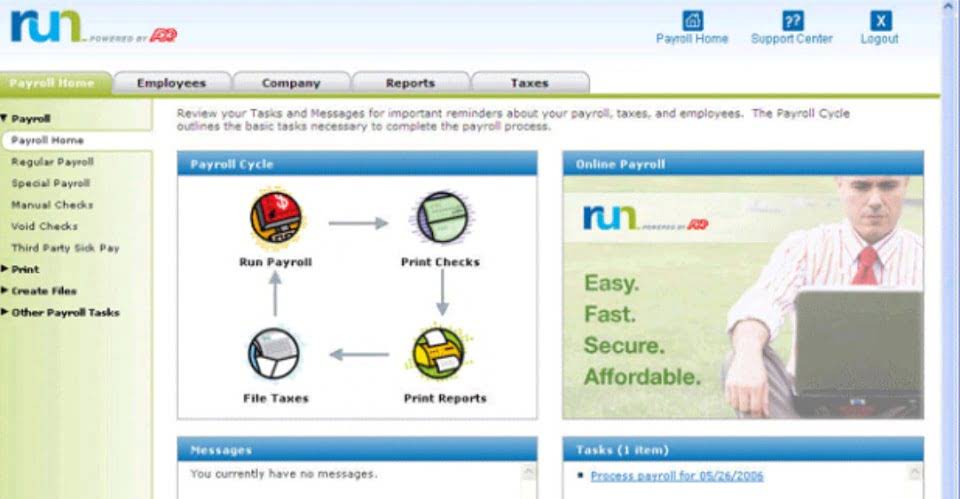

- • Prepare and process payroll, ensuring accuracy and compliance with relevant regulations.

You will report directly to the owner of the organization and will engage outside CPA firm to prepare financial statements and tax returns as needed. Diploma and have a Certified Bookkeeper designation with at least one year of supervisory experience. You will have at least 5 years of experience in a bookkeeping role and advanced accounting and bookkeeping software experience. You will have an aptitude for business and be detail oriented and have experience with financial statements and tax returns.

Difference between a Full-Charge Bookkeeper and a Regular Bookkeeper

A small mistake in data entry or calculation can have significant implications for a company’s financial records. By being meticulous and thorough in their work, bookkeepers can maintain accurate financial records and ensure the integrity https://www.bookstime.com/ of the company’s financial information. We are looking for a detail-oriented Full Charge Bookkeeper who will take overall responsibility for managing all financial transactions and maintaining accurate records for our company.

- These certifications provide a comprehensive understanding of bookkeeping principles, practices, and regulations.

- This includes staying updated on financial laws, regulations, and reporting requirements.

- The full charge bookkeeper will supervise these employees, helping to organize work flow and verifying accuracy of work.

- While not mandatory, obtaining a certification in bookkeeping or accounting can significantly enhance a full charge bookkeeper’s qualifications.

- To navigate these waters successfully, developing robust financial strategies is essential.

Bookkeeping Job Description

Responsibilities for bookkeepers can vary widely from business to business, though there are a number of very common bookkeeping responsibilities. Remember that you want to tailor the role’s responsibilities in the job description full charge bookkeeper job description so that it’s not just aligned with the position but with your company. The job description successfully avoids common pitfalls such as using jargon, being excessively lengthy, or failing to describe the job role adequately.

- Having this capacity allows them to keep their ledgers and financial reporting accurate, which is a vital goal in their profession.

- Remember that you want to tailor the role’s responsibilities in the job description so that it’s not just aligned with the position but with your company.

- Strong organizational skills are essential for a full charge bookkeeper to effectively manage multiple financial tasks and deadlines.

- Full-charge bookkeepers actively participate in decision-making processes and provide business owners and managers with valuable financial insights.

- While regular business hours are the norm for a full charge bookkeeper, there may be occasions when you are required to work overtime.

Full Charge Bookkeeper Responsibilities:

This includes working closely with accountants, financial analysts, and payroll administrators to ensure accurate and up-to-date financial data. Communication and teamwork are key in maintaining the financial health of the organization. Another important responsibility of a full charge bookkeeper is managing payroll. This includes ensuring accurate and timely processing of employee salaries, benefits, and deductions. You also handle payroll tax calculations, ensure compliance with payroll regulations, and maintain payroll records.

Ethical Considerations in Bookkeeping

- These programs provide you with the skills and information needed to handle activities connected to tax, auditing, and accounting processes, as well as economics, business law, and business math.

- This involves tracking all cash inflows and outflows, ensuring sufficient funds are available to meet the company’s financial obligations, and identifying potential cash flow issues.

- Read our case studies to understand how Jobsoid has streamlined their hiring processes significantly.

- You also handle the collection of receivables, ensuring that customers pay their invoices on time.

- They are often engaged by growing businesses that cannot handle all the financial tasks on their own.

Required Skills for a Full Charge Bookkeeper